Insider’s advantages pick the best services which will make wise decisions along with your currency (here’s how). Occasionally, i discovered a commission from your our very own couples, however, the views are our personal. Words connect with has the benefit of listed on this site.

- Signature loans are often kepted of these to the most useful borrowing scores, however, there are other options to borrow cash if needed.

- Playing with credit cards, delivering a pay-day solution loan off a card commitment, or credit out-of friends or nearest and dearest are options when you are unable to rating bucks as a result of a consumer loan.

- These types of alternatives are not best: Handmade cards can have higher interest rates, and obtaining loans of members of the family should be high-risk. Make use of them after you’ve appeared your own personal loan options and just have utilized your own crisis funds.

- Read more private fund coverage »

A personal loan isn’t an easy task to get. They have been tend to only available to the people with the best credit scores and you may good credit record plus they are unsecured, meaning that there’s absolutely no equity available for financial institutions to use to help you recoup money for those who end spending. If you have a poor credit get or a high debt-to-earnings proportion, you could find it tough to locate that loan.

That’s not to say they’re completely from the table. Imagine looking around with some other lenders before carefully deciding you to definitely a personal bank loan would not functions, and you may dip into disaster coupons prior to getting a loan. If you’ve appeared available for a personal bank loan to cover their expense and can’t find one to you personally, here are three alternative selection.

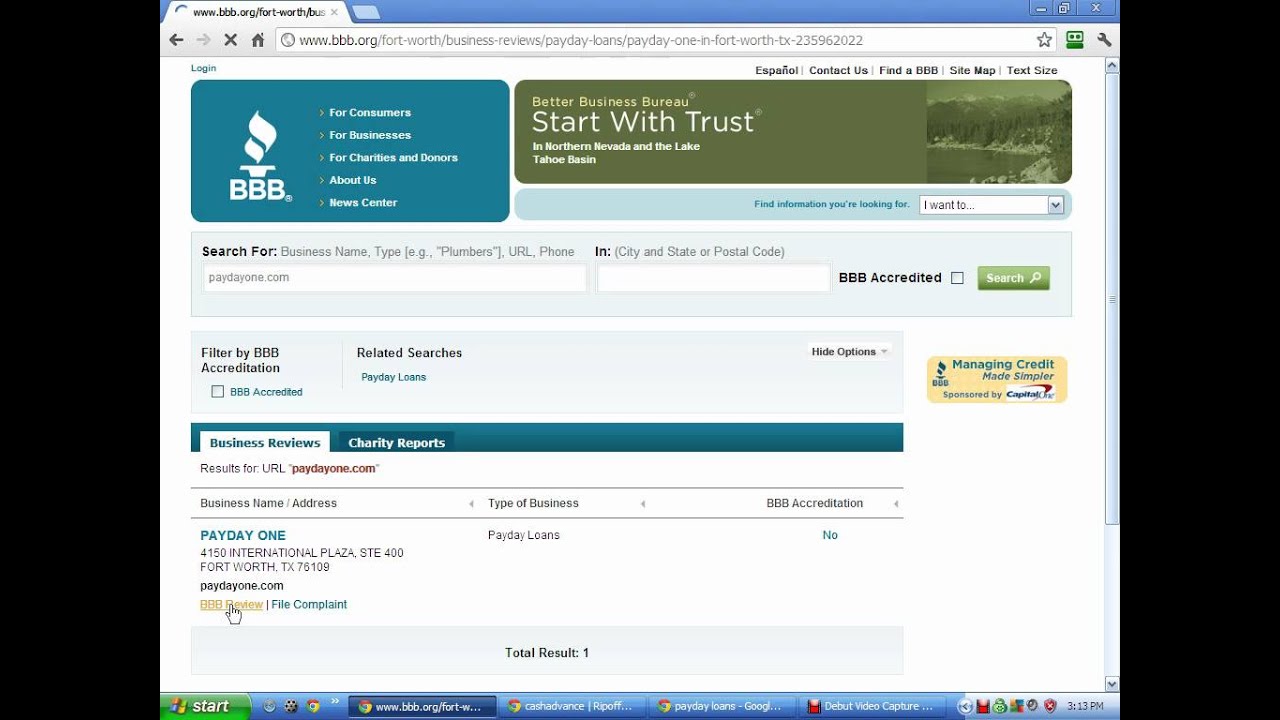

step one. Pay check solution mortgage regarding a cards union

Payday loan are not best for individuals. They frequently keeps incredibly large interest rates – the typical payday loans is interested speed of over eight hundred%, according to Consumer Monetary Safeguards Agency.

Pay day alternative finance, but not, was a much better choice for a tiny mortgage. Considering as a result of borrowing unions, these types of money has actually a max interest rate regarding twenty eight%, lower than some personal bank loan options. The quantity available essentially range out-of $two hundred to help you $step 1,000. Pay day choice financing keeps app fees capped at the $20, and you will loan terms anywhere between you to and you can 6 months, according to the Federal Borrowing Commitment Management.

These types of solution money was an option for anyone who need an effective few dollars easily. While they’re limited in order to credit commitment players, joining a card connection – which in turn keeps registration conditions, such as for instance home from inside the a certain town – is commonly really accessible These finance are managed from the National Borrowing from the bank Union Management, and they are supposed to let people end predatory lending strategies at pay-day loan providers.

dos. A credit card

Into the normal circumstances, the best way to explore a credit card feels like an excellent debit credit: to invest simply currency you really have, therefore you may be never accumulating financial obligation. Yet not, if you want cash instantly, playing cards will let you borrow funds during the small amounts from the an occasion, and pay it off. Be aware that they shall be an even more high priced solution than just signature loans for individuals who find yourself carrying an equilibrium – your balance often accrue appeal each month, hence attention substances as well.

The typical charge card has an interest price out-of %, according to studies throughout the Federal Reserve. It’s worth listing one a cards card’s interest provided may vary based on multiple products, together with someone’s credit score. Interest rates can also change by themselves in line with the best price that finance companies are charged in order to use.

If you do want to safety expenditures which have credit cards, get a hold of a cards on the lowest you are able to Apr – a reduced costs getting borrowing. Ideally, you need to pay-off what you owe in full monthly. Once you learn you won’t manage to do this, envision a card which have a great 0% basic Apr, and therefore would not costs desire to own an introductory months (however, usually restart battery charging appeal shortly after that time try up).

3. Obtain off members of the family or relatives

That one can be tricky,  nonetheless it will be a selection for whoever has family unit members or family members happy to drift them financing. Borrowing off friends or family should-be a history lodge, writes Luke Landes, your own financing publisher and creator from the Consumerism Commentary. And you may, that one doesn’t already been instead of dangers – it may harm dating writes Catherine Fredman for Individual Records.

nonetheless it will be a selection for whoever has family unit members or family members happy to drift them financing. Borrowing off friends or family should-be a history lodge, writes Luke Landes, your own financing publisher and creator from the Consumerism Commentary. And you may, that one doesn’t already been instead of dangers – it may harm dating writes Catherine Fredman for Individual Records.

You will find some guidelines for taking this approach the right way. Financial planner Mary Beth Storjohann before informed Company Insider’s Tanza Loudenback you to definitely she implies while making a written plan. “Place the variables in place – time period, rate of interest, if in case repayments need initiate,” she claims. Storjohann means charging you attention towards finance to greatly help secure the borrower responsible, while making a tiny incentive with the lender.

Recent Comments